maine tax rates by town

Full Value Tax Rates Each year Maine Revenue Services determines the full equalized value of each municipality and subsequently calculates a full value tax rate. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

Local Maine Property Tax Rates Maine Relocation Services

Counties in Maine collect an average of 109 of a propertys assesed fair market.

. Municipalities may by vote determine the rate of interest that shall apply to taxes that become delinquent during a particular taxable year until those taxes are paid in full. The total sales tax rate in any given location can be broken down into state county city and special district rates. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

Combined with the state sales tax the highest sales tax rate in Maine is 55 in the cities of Portland Bangor Lewiston South Portland and Augusta and 104 other cities. Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are. Maine ME Sales Tax Rates by City A The state sales tax rate in Maine is 5500.

E-911 Street Name and Addressing. Municipal Services and the Unorganized Territory. The Town of Palermo operates on a calendar year from January to December.

There are no local taxes beyond the state rate. The rates that appear on tax bills in Maine are generally denominated in millage rates. The Property Tax Division prepares a statistical summary of selected municipal information that must be annually reported to MRS by municipal assessing officials.

State of Maine Online Septic Plan Search. 2022 Taxes were committed on September 17th with payment due on November 17th. ESTIMATED FULL VALUE TAX RATES State Weighted Average Mill Rate 2020 Equalized Tax Rate derived by dividing 2020 Municipal Commitment by 2022 State Valuation with adjustments for.

How does Maines tax code compare. Maine has recent rate changes Wed Jan 01. 27 rows The personal and corporate income tax generated 30 of that total and the sales tax.

Maine ME Sales Tax Rates by City The state sales tax rate in Maine is 5500. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a. Part of the state valuation process includes the preparation of a statistical summary of certain municipal information that must be annually reported to MRS by municipal assessing officials.

The Municipal Officers of the Town of Bar Harbor upon request of the Tax Collector of said municipality hereby require and direct pursuant to 36 MRSA 906 that any. These tax rates are. Our division is responsible for the determination of the annual equalized full value.

A mill is the tax per thousand dollars in assessed value. For example a home with an assessed value of. A wealth of information.

13 rows Tax Rates The following is a list of individual tax rates applied to property located in. Maine also has a corporate income tax that ranges. Maine has a 55 sales tax and Washington County collects an additional.

Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The Property Tax Division is divided into two units. Tax Rates LD 290 - Stabilization of Property Taxes - Application and.

Assessor Commits 19 92 Property Tax Rate For 2020 21 Town Of Cape Elizabeth Maine

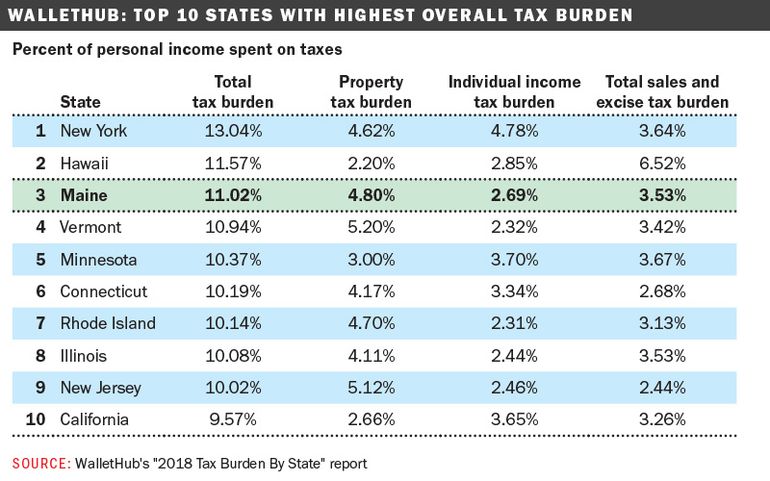

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

Property Taxes Urban Institute

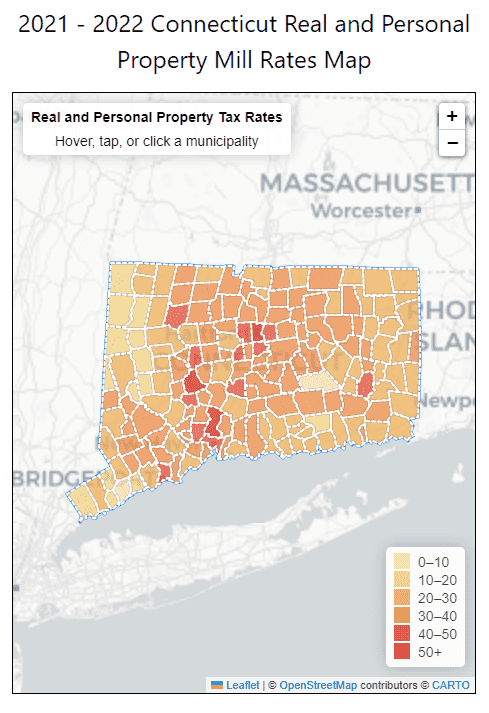

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

Maine Sales Tax Calculator And Local Rates 2021 Wise

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

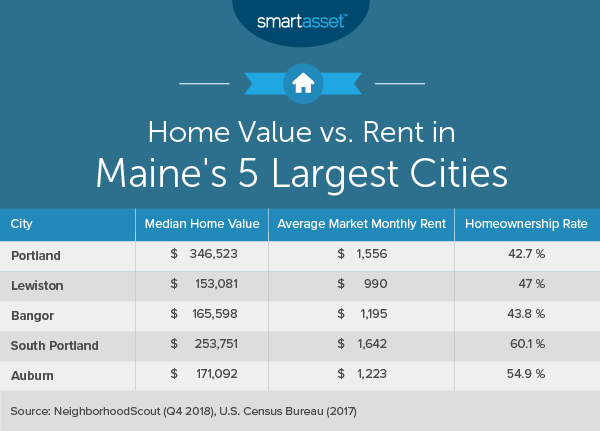

What Is The Cost Of Living In Maine Smartasset

Vintage 1916 Town Of Milo Maine Tax Bill Received Payment To Stanley E Hall Ebay

Maine Estate Tax Everything You Need To Know Smartasset

Maine Tax Brackets And Rates 2022 Tax Rate Info

Historical Maine Tax Policy Information Ballotpedia

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

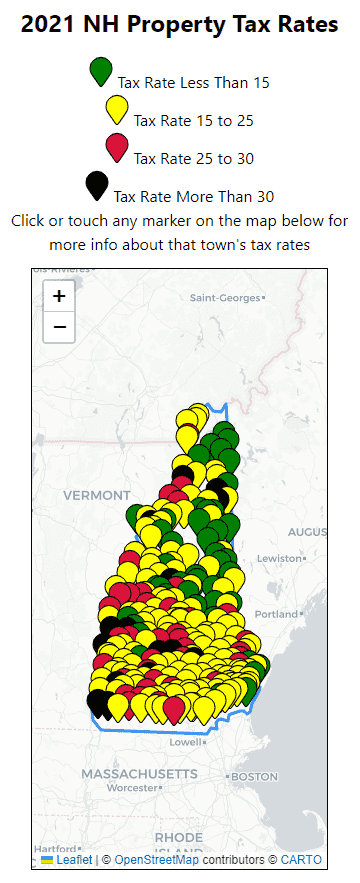

2021 New Hampshire Property Tax Rates Nh Town Property Taxes